This article first appeared in The Australian Business Executive Magazine on the 25th of September 2023. Available at: https://theabe.com.au/management-consultant-and-economist-dan-hadley-long-covid-the-economic-hangover-of-government-stimulus/

The COVID-19 pandemic needs no introduction. You would have to be a member of a primitive tribe on an isolated island or be in a coma for the past several years to not know about COVID-19. Its reach, effect and power have changed the world to such a degree that it is measured against the Global Financial Crisis and September 11 (2001) in terms of its global impact. Emerging in late 2019, “the Coronavirus” had far-reaching economic consequences, with one of the most significant being the increased cost of living in many countries around the world. As governments attempt to grapple with the economic fallout of the pandemic, nations have implemented various measures to address the steep rise in costs and provide relief to everyday people on the ground.

The key factors contributing to the increased cost of living

Supply chain disruptions

Lockdowns and restrictions on movement disrupted global supply chains, leading to shortages and higher prices for various goods. The inability to access raw materials and components has affected industries ranging from manufacturing to tech, ultimately affecting consumer prices. There are still backlogs for many goods post-COVID. An extreme example being the estimated five to 10 year wait time for a Rolex Daytona watch.

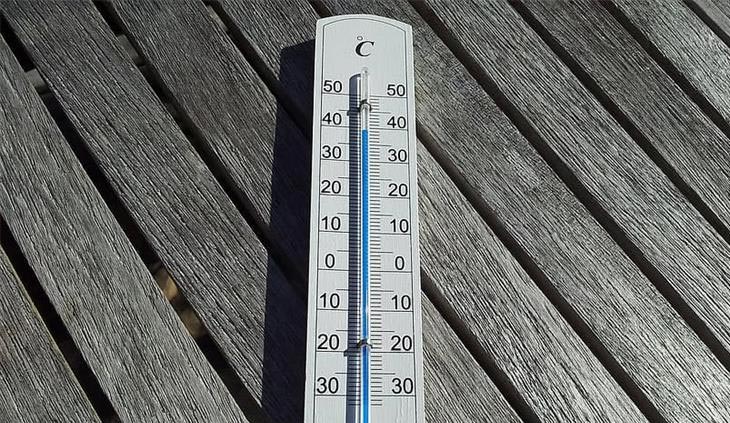

Inflation

One of the most prominent factors driving the increased cost of living is inflation. During COVID-19, governments worldwide implemented monetary and fiscal policies to stimulate their economies, such as low-interest rates and large-scale financial assistance programs (handing out assistance funds to citizens). These policies have increased the money supply and, in turn, driven up prices, leading to inflation.

Housing market

The housing markets in both North America and Australia have experienced significant surges in demand, with many individuals seeking larger homes or relocating due to remote work opportunities. This has driven up property prices and rental costs, making housing less affordable for many people. Build times have been blown out also. What was once considered normal for a build time (around 9 months) has blown out to the 2-to-3-year mark for a residential home.

Energy prices

The cost of energy, including gas and electricity, has risen in many countries, contributing to increased household expenses. The family budget has been hit hard in both North America and Australia. According to the ACCC’s (Australia) report, the state of South Australia experienced a 9.1 per cent increase in their household quarterly median electricity bills between the September quarters 2021 and 2022, which was the highest of all National Electricity Market regions for the country. In the US, average consumer electricity prices rose by up to 20% in many states from November 2022 against a year earlier according to the US Energy Information Administration.

Healthcare

The pandemic highlighted a new emphasis and importance of healthcare, leading to an overall increased demand for medical services in most countries and, in some cases, higher healthcare costs for individuals and governments. On the whole, the healthcare sectors of both Australia and the US, came under great strain with logistical demands soaring during and after COVID.

Government economic interventions in the United States

The US, like many countries, has faced the challenge of addressing the increased cost of living post-COVID head on. In any economic crisis the decision of whether to act or not and what to do is a critical one. Governments must weigh the costs and benefits as well as future costs carefully. In the US, a range of key responses were taken.

Infrastructure investment

The US federal government passed a substantial infrastructure bill, aimed at improving transportation, broadband access, and clean energy. This investment, based on bringing future work projects forward, was expected to create jobs and stimulate economic growth, which could indirectly help alleviate the cost of living for US citizens and promote economic activity.

Healthcare reform

The Senate debate over healthcare reform continues, with discussions on expanding access and controlling or limiting prices. The US government’s approach to healthcare policy will play a significant role in addressing rising healthcare expenses but ultimately the cost is going to be borne somewhere by the taxpayer. The conservative side of the aisle have continued to promote the need for an entire shakedown of the sector with a free-enterprise solution to the healthcare service supply.

Fiscal stimulus

The US government implemented several stimulus packages to provide financial relief to individuals and businesses across all states. These packages included direct payments to citizens through social welfare and tax mediums and increased unemployment benefits. While these measures helped many Americans make ends meet in the short term, they also added to the federal deficit and have contributed to the increased inflation and cost of living crisis.

Monetary policy

The US Federal Reserve has kept interest rates near zero for many months to stimulate borrowing and spending. While this has supported economic activity in the associated economic recovery, it has also contributed to rising inflation. Where more money is available, more spending occurs, and prices go up.

Housing initiatives

In an effort to address the housing affordability crisis, the Biden administration have proposed significant investments in affordable housing projects and initiatives to help first-time homebuyers. In 2023 Congress introduced 10 various bills offering tax credits and cash grants to home buyers. These include a one-time $15,000 “First-Time Home Buyer Tax Credit” under the LIFT Act, which also provides a lower than market mortgage interest rate for eligible home buyers.

Government planning in Australia

Australia is economically unique when compared against many other nations. Australia’s particular challenges, size of land, geographic position and respective resources provide for a different landscape of economic “strengths and weaknesses.” The Australian federal Government have also responded to the increased cost of living post-COVID.

Economic support

The Australian government introduced various economic support measures, including wage subsidies like the “JobKeeper” program during COVID, to help businesses retain employees during the pandemic lockdown periods. These fiscal measures aimed at preventing widespread job losses and supporting income levels for households. Reliance on these measures for some business only delayed the inevitable, however.

Infrastructure investment

Similar to the United States, Australia has embarked on significant infrastructure projects to boost economic activity and create jobs. In a similar vein, these projects were largely the act of “bringing forward” future planned Investments in transportation, renewable energy, and digital infrastructure. These projects are expected to have long-term economic benefits, however.

Housing policies

Australia has experienced a housing affordability crisis for years, which the government has sought to address through policies promoting affordable housing developments and first-time homebuyer grants. Building stimulus payments during COVID have served to increase demand in the housing market greatly leading to a massive increase in housing input material costs and a major delay in individuals having their home built.

Energy Transition

The Australian federal government has set ambitious goals for transitioning to renewable energy sources. Investments into clean energy and technology are designed to reduce long-term energy costs and address climate change concerns as well as deal with the finite energy resource issue. This race towards non-fossil fuel-based energy has helped to increase the cost of energy in the immediate term however and households have experienced the pain in their back pockets.

Government market intervention

Both the United States and Australia have employed some various shared applications of market intervention to address the increased cost of living. Central banks in both countries have played a significant role in managing economic conditions through monetary policy. They have used tools like interest rates and quantitative easing to influence borrowing costs, inflation, and economic growth. Adjusted taxation measures have also been a powerful tool for income redistribution. Progressive tax policies can help reduce income inequality and support those facing higher living costs in the short term but can also hinder economic activity and the desire to engage in new business.

Governments on both sides of the globe have also run various social welfare programs to provide targeted assistance to those in need. These programs include unemployment benefits, food assistance, and housing support. They have their place and very few would begrudge a hand up in a difficult time. Some evidence suggests that citizens can become reliant on such measures and this may have the effect of decreased workforce participation. Governments across the world have also provided trillions of dollars’ worth of subsidies and incentives to specific industries or activities they want to promote. These can have the effect of promoting a faster rate of growth and development as seen in the renewable energy sector.

Summary

The increased cost of living post-COVID has presented a significant challenge for governments worldwide. In the United States and Australia, governments have responded with a combination of fiscal stimulus, monetary policy, infrastructure investment, and market intervention. While these measures have provided relief and support for their citizens, they have also raised questions about their long-term economic and fiscal consequences. Yesterday’s debt and enjoyment is tomorrow’s pain.

Balancing the need to address rising living costs with maintaining economic stability and fiscal responsibility is a complex task. The success of these government plans will depend on their effectiveness in managing run-away inflation, promoting sustainable economic growth, and ensuring that the benefits reach those most affected by the increased cost of living. As the world continues to recover from the pandemic, these challenges will remain at the forefront of economic policy discussions in both countries and around the globe. As men and women across the globe continue to tighten their belts and exercise greater and greater personal austerity, one wonders when and if, the normal cost of living might ever return.